|

Many of us have heard of the 529 College Savings Plan, some of you may have actually set it up for your child(ren) already (good job!!!), but if you're like me you never really gave it much thought. I've always been of the mind frame that we'll save as much as we can in the bank, stock market, and real estate, and not allocate funds for anything specific. I want it all accessible at any moment for whatever it's needed for, whether it's illness, job loss, vacation, college, or retirement! However, I was recently compensated to attend and report on a seminar about NY's 529 College Savings Plan and I gotta tell you, guys, I think I may have been wrong! YIKES!!! Organized by Mom Trends, our seminar's speakers included Vanugard's Mary Ryan - Director of the NY 529 College Savings Program, and Michael Turner of NY State Higher Education Services. Below are the key points I gleamed from the seminar that surprised me and really got me thinking about things. I hope you find them helpful, too!! What's a 529? The 529 is a type of investment plan used for higher-education, usually sponsored by states. Your money grows federally tax-deferred and qualified withdrawals are tax-free. If you live OR work in New York, you're lucky, because ours is one of the best!! Important numbers:

Management options:

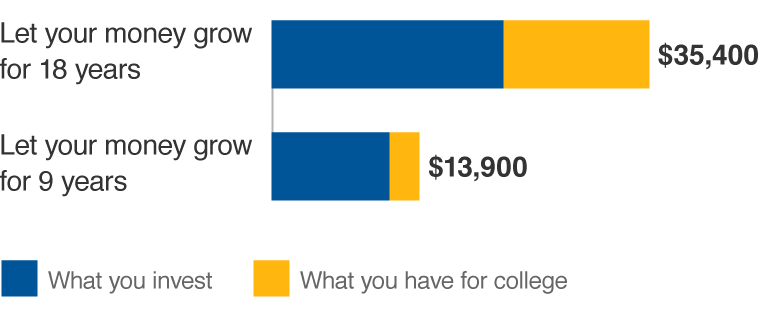

Compound Interest... is your best friend!! It's basically earning money on your investment, and earning money on those earnings!! It's the idea behind any investment plan, 529 just has the added benefit of all of the tax breaks. Here's a great visual on how compound interest works from NYSaves.org (using a $100 monthly contribution and 5% interest rate for their example): 529 isn't just for college tuition! Your savings can be used toward any qualified higher-education expense in or out of your state, even abroad! These can include tuition, books, room & board, study abroad, college / university, graduate school, vocational & technical school, computer & software, etc! Even if they get a large scholarship, there is often a significant gap between what is covered and remaining expenses, which usually include room and board, books, and more. This is something the 529 plan can help with tremendously! Our kids got to do some cooking at the Institute of Culinary Education while us mom bloggers learned about NY's 529 Plan... what if one of these kids doesn't want to go to college and wants to be a chef instead? They can use their 529 savings to attend a certified culinary school!! 529 savings can be transferred to various family members! Let's say your child is a genius or star athlete and gets a full ride (room and board - everything is covered) - you can hold their savings for their graduate school (which is much harder to fund with financial aid and scholarships), or you can transfer it free of charge to a sibling, yourself or your partner (maybe you've always dreamed of getting your Master's - why not now!?), a cousin, or even a grand child. 529 donations instead of birthday / holiday / graduation gifts! Do you have friends or family members who send your child checks for their birthday? How about providing them a link to contribute that money into your child's 529 plan instead (you can set this up through UGift)! If it's a grandparent who would like the tax benefits, they can open up another account for your child themselves in whatever state they work in (only the account owner is eligible for the state income tax deduction)! There's no limit to how many accounts can be opened per child/beneficiary, and there's no age limit. How does this impact financial aid and the new Excelsior Scholarship? The Excelsior Scholarship (brand new in 2018 - students in households earning under $125,000 a year can go to any CUNY/SUNY school for free) and many other scholarships and grants look only at salary, not savings. In these situations, how much parents have saved in 529 plans, Roth IRA, or in the bank wouldn't have any impact on aid offered to the student! When assets are considered, savings and Roth IRA plans owned by the parents are looked at but only a small percent is calculated to be available to cover a child's higher education expenses (because they realize you need that money for your home, regular expenses, retirement, etc). Custodial accounts, where your child is the account owner, however, WILL greatly impact eligibility for financial aid. Every penny will be expected to go toward their cost of education. So, keep this in mind when deciding to open up a regular savings account for your child! Definitely something to discuss with a financial planner! If you don't have a good financial planner, a dear local mama friend of mine is a GREAT one and I highly recommend her, you can reach out to her here with all of your questions! Amber Flanagan of NY Life Securities TEL (347) 574-6615 [email protected] Penalties for non-qualified withdrawals If your kids don't use the money and you don't want to transfer it to another family member, or if you find yourselves in desperate need of the money, you can withdraw it for other use, however it'll be subject to all the taxes that had previously been deferred (federal, state, local) as well as a 10% federal penalty tax and other possible penalties. What if we move? To transfer your 529 from one state's plan to another, according to the NY 529 Disclosure Booklet, you'd be "subject to New York State income taxes on the earnings portion, as well as the recapture of any previous New York State tax deductions taken for contributions to the Account". Potentially, NY could view moving your plan to another state as a non-qualified withdrawal!! So, it may be in your best interest to let the account stay in NY, continuing to accrue interest. You can continue to contribute to it from your new home, though you won't receive the NY state tax benefits on new contributions at that point. If your new state has a great 529 plan with tax benefits, you can open a new one there and start contributing to that one, pulling from both accounts when your child gets to college age. So, what do you think?? Are you going to look into the 529 plan more and set one up?? Leave a comment below with your thoughts - I'd love to hear more personal experiences - why you have or haven't set one up, what your accountants or financial planners have advised you, etc!!! Disclaimer: Though I was compensated to attend this seminar and provide a blog post about it, thoughts and opinions are my own and completely unbiased. I did my best to summarize my understanding from the seminar, but some information could be inaccurate. Please consult a professional financial advisor to discuss any questions or concerns!! As mentioned above, my friend Amber is a great one!

5 Comments

Gabriela

4/26/2017 01:20:09 pm

Great info!!! Thanks !!

Reply

5/1/2017 09:52:50 am

It can be so overwhelming to start saving, I'm glad you made it to the event and took in all this info. Here's to giving our kids the best we can!

Reply

Leave a Reply. |

About ME:I'm a NYC metro area mom blogger living in NJ with my Japanese husband & our 3 kids (twins plus 1), focusing on fun and honest product and travel reviews, saving moms time finding the best for their families! Find what you need in the menu bar or search section above! Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed